Introduction

Haryana has long been one of India’s industrial powerhouses. From its agricultural roots to the rise of manufacturing and IT/ITES, the state has evolved dramatically. In 2025, Haryana stands at a new inflection point: ambitious government policies, startup momentum, favourable location (adjacent to Delhi NCR), infrastructure upgrades, investor interest, and global trends (EVs, green energy, digital transformation) are creating multiple high-opportunity sectors.

This article examines the Top 10 business sectors in Haryana in 2025, why each is poised for growth, what opportunities exist, what challenges entrepreneurs face, and what future trends look like. It aims to be a guide for entrepreneurs, investors, policy makers, and anyone interested in what’s next for Haryana’s business landscape.

Haryana’s Economic Snapshot (2024-25)

Before diving into individual sectors, here’s the current business environment in Haryana, with key metrics and context:

- GSDP & Growth: Haryana’s Gross State Domestic Product has been growing at about ~10-11% over the past decade. In budget and state reports, it’s noted that in the last 10–11 years, the state has seen strong industry growth and the manufacturing sector is expanding. The Times of India+1

- Startups & MSMEs: The state has established a strong ecosystem for startups. As of mid-2025, Haryana has emerged as the 7th largest state in terms of DPIIT-recognized startups, numbers over 8,800 or ~9,100 in some reports, with a notable portion (almost half in some reports) of women-led startups. The Week+1

- Ease of Doing Business & Industrial Infrastructure: The government has simplified many regulatory compliances: reducing over 1,100 compliances across many departments, offering one-roof clearances. Also, new Industrial Model Townships (IMTs) are being planned or developed (e.g., Ambala, Jind, Faridabad-Palwal, etc.). The Week+1

- Foreign Direct Investment & SEZs: Haryana has attracted large foreign-investor presence. Key investor companies include global names in auto, electronics, IT, etc. The state has multiple SEZs and industrial estates. India Briefing+1

- Policy Support: Policies like the Atmanirbhar Textile Policy 2022-25 (extended), subsidies in textiles, electronics, auto components, renewable energy, etc. are in place. The state is pushing to become a manufacturing hub by 2047 with strengthened industry-and-commerce budgets. India Brand Equity Foundation+2Hindustan Times+2

With this backdrop, let’s explore the top sectors.

The Top 10 Business Sectors in Haryana in 2025

Here are the ten sectors that are especially promising in Haryana now, with what’s fueling their growth and what to watch out for.

1. Automobile & Auto Components / EVs

Why this sector is critical:

- Haryana is already one of India’s largest automobile manufacturing hubs. It produces a significant share of India’s passenger cars, tractors, and motorcycles. India Brand Equity Foundation+1

- Demand for EVs (electric vehicles) is rising, with national policy push, subsidy schemes, and charging infrastructure development.

Growth Drivers:

- OEMs wanting localized components to reduce supply chain delays and costs.

- Government incentives for EV component manufacturing.

- Infrastructure improvements (roads, logistics) that facilitate transport.

- Workforce availability (skilled and unskilled), plus proximity to markets (Delhi, NCR) for distribution.

Recent Projects & Examples:

- Maruti Suzuki announced in FY25 a large investment (~₹7,410 crore) to set up a third manufacturing plant at Kharkhoda, indicating rising demand for capacity. India Brand Equity Foundation

- Haryana’s auto component clusters around Manesar, Gurgaon, Faridabad continue to attract suppliers.

Opportunities:

- Setting up battery-pack assembly plants, charging infrastructure, EV component supply (motors, controllers).

- Tier-2 and Tier-3 supplier units focusing on plastics, wiring harnesses, metallic stamping etc.

- Retrofit EV conversion services, EV maintenance, and battery recycling / life-extension services.

Challenges:

- High upfront capital expenditure.

- Technical standards & certification for EV/auto parts.

- Power reliability and cost of energy.

- Competition from other Indian states offering similar incentives.

Future Trends:

- As EV adoption increases, demand for fast chargers, battery swap stations.

- Localisation of battery chemistry (cells), possibly module & pack manufacture.

- Industry moving toward sustainability: lighter materials, recyclable components.

2. Information Technology / ITes / Electronics

Why this sector is rising:

- Gurugram has long been a major corporate & IT hub; nearby areas are benefiting from spillover demand.

- Electronics and semiconductor policies and incentives are being planned to make India less dependent on imports. Haryana’s position is favourable for attracting electronics firms. Nuclear Edge+2The Times of India+2

Growth Drivers:

- Startup ecosystem—recognized startups, incubators being created like H-HUB. The Times of India

- Global Capability Centers (GCCs) in Gurgaon and other NCR areas.

- Electronics manufacturing units (PCBs, semiconductors), particularly with central policy push.

- High digital connectivity and availability of talent.

Recent Projects & Examples:

- The creation of a world-class incubator (H-HUB) in Gurugram announced in 2025–26 budget, with infrastructure for prototyping, product R&D, etc. The Times of India

- Electronics policy and incentives for firms are active; many firms in Haryana are in outsourcing / service-based segments. India Briefing+2Nuclear Edge+2

Opportunities:

- Setting up product companies (software, hardware) rather than just service centres.

- Semiconductor / electronics manufacturing: PCBs, modules, sensors.

- Embedded systems for EVs, IoT devices.

- IT-ITES services for AI, cloud, cybersecurity.

Challenges:

- Need for skilled workforce in hardware, semiconductor tech.

- Power and clean manufacturing infrastructure.

- Global competition and import dependencies.

- Land, licensing, environmental approvals for electronics fabs or associated facilities.

3. Real Estate & Infrastructure Development

Why this sector is key:

- The NCR spillover effect ensures continued demand for residential and commercial real estate in Gurugram, Faridabad, Sohna, etc.

- Infrastructure projects (roads, expressways, airports, industrial corridors) are being planned / executed to support business and population growth.

Growth Drivers:

- Demand from both corporate and residential segments.

- Government budget allocation for infrastructure: transport, industrial model townships, clean air, urban development projects. India Brand Equity Foundation+1

- IMTs and industrial clusters being developed.

Recent Projects & Examples:

- The Hisar Industrial Manufacturing Cluster near Hisar airport: ~₹4,680 crore investment, over 3,000 acres, part of the Amritsar-Kolkata Industrial Corridor. Pi-India+1

- DLF’s new shopping mall in Gurugram, big residential / commercial projects in Manesar, Faridabad etc. India Brand Equity Foundation

Opportunities:

- Industrial real estate: land, roads, infrastructure in IMTs.

- Warehousing, logistics parks.

- Residential affordable housing, mid-luxury segments for NCR commuters.

- Mixed use developments combining commercial, retail, residential.

Challenges:

- Land acquisition and cost.

- Environmental / zoning approvals, regulatory complexity.

- Fluctuations in input costs (steel, cement).

- Infrastructure of utilities (water, electricity) and waste management.

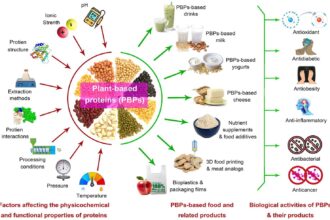

4. Agriculture & Food Processing / Agro-based Businesses

Why this is foundational:

- Haryana has been agricultural since long, with high yields of wheat, rice, dairy, horticulture.

- Food processing reduces post-harvest losses, adds value, creates export opportunities.

Growth Drivers:

- Rising demand for processed foods, packaged goods, organic produce in urban markets.

- Cold chain, storage, mechanisation improving.

- AgriTech startups working on supply chain, farm inputs, contract farming.

Recent Projects & Examples:

- Best Business to Start in Haryana articles list food processing, agro-based business, cold storage units etc. Niir Project Consultancy Services

- Haryana dairy cooperative (Vita brand) is a state example in dairy products. Wikipedia

Opportunities:

- Setting up food processing units (juices, snacks, ready-to-eat), cold storage, warehousing.

- Organic farming, specialty crops, value-added products (spices, herbs).

- Agri inputs (fertiliser, seed, mechanisation), farm-to-market digital platforms.

Challenges:

- Logistics & cold chain gaps, especially in rural districts.

- Quality, food safety, packaging and export standards.

- Capital for infrastructure, training for farmers.

- Seasonality and weather risks.

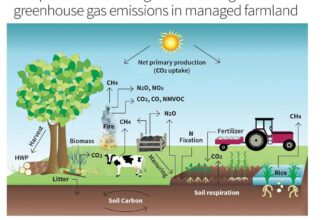

5. Renewable Energy & Clean Tech

Why this sector is rising:

- National and state policies are pushing clean energy, solar, green manufacturing.

- Haryana is home to new solar module manufacturers (for example, HVR Solar scaling to 2 GW in industrial corridor in Sonipat). The Economic Times

Growth Drivers:

- Solar parks, rooftop solar, subsidies or incentives for renewable energy.

- Increasing demand for clean power from industrial and commercial consumers.

- Global ESG pressure and corporate sustainability commitments.

Recent Projects & Examples:

- HVR Solar’s new 2 GW module manufacturing facility in Sonipat. The Economic Times

- Government policy announcements for clean air project, renewable manufacturing etc. India Brand Equity Foundation+1

Opportunities:

- Solar EPC (engineering, procurement, construction) firms.

- Rooftop solar for industrial estates.

- Solar module or component manufacturing.

- Clean energy allied businesses: storage, green hydrogen (as pilot), O&M, financing models.

Challenges:

- Capital intensity, economies of scale.

- Regulatory delays or land issues.

- Grid integration, power evacuation.

- Skills in clean tech and O&M.

6. Textiles & Garments / Fashion & Apparel

Why important:

- Haryana has textile clusters (e.g., Panipat) known for carpets, rugs, home textiles. Also garment manufacturing and apparel supply chains exist.

- National textile and apparel policies favour modernisation and export-oriented production.

Growth Drivers:

- Extension of Textile Policy (Atma Nirbhar Textile Policy extended till December 18, 2026) with incentives like capital investment subsidy, interest subsidy, SGST benefits. India Brand Equity Foundation+1

- Global buyers looking for alternative sourcing, demand for home textiles, sustainable fabrics.

Recent Projects & Examples:

- Textile policy extension, removal of cap on cases for capital investment subsidy for textile units. projxnews.com

- Clusters in Panipat, Yamunanagar etc.

Opportunities:

- Home-textiles, carpets, rugs for domestic and export markets.

- Sustainable / organic textiles, recycled fabrics.

- Garments / fashion brands with local manufacturing.

- Supporting industries: dyes, finishing, packaging, logistics.

Challenges:

- Environmental compliance (wastewater, effluent treatment).

- Competition from lower-cost producers (other Indian states or abroad).

- Need for design, branding, and export certifications.

7. Startups / Innovation / Technology-led Ventures

Why this sector is rising:

- Strong recognition growth: Haryana now has thousands of DPIIT-recognized startups, many incubators, increasing number of unicorns. The Week+1

- Government support via incubators, startup policies, and the push for semiconductors & electronics.

Growth Drivers:

- Policy frameworks: startup-friendly regulation, incubator infrastructure (e.g. H-HUB), single-window clearances. The Times of India+1

- Talent base – engineering colleges, research institutions.

- Demand for tech solutions in traditional sectors (agri, logistics, health).

Recent Projects & Examples:

- The announced world-class incubator (H-HUB) in Gurugram. The Times of India

- The state emerging with many unicorns (19 unicorns mentioned in one report). The Week

Opportunities:

- Deep tech: electronics, semiconductor, AI, IoT.

- AgriTech, HealthTech, FinTech for mass markets.

- Drones and drone tech (as the state aims to become a drone tech hub). The Times of India

- SaaS (for services, enterprises), GCCs (Global Capability Centers).

Challenges:

- Access to venture capital, especially for hardware startups.

- Scale: many startups may struggle to move from prototype to mass production.

- Infrastructure for R&D, power, facilities.

- Retaining talent vs brain drain to metros like Bengaluru, Mumbai.

8. Logistics, Warehousing, Supply Chain & Cold Chain

Why essential:

- Haryana’s location (NCR, proximity to ports/airports, key highways) gives logistics and warehousing a natural advantage.

- Growth of e-commerce and perishable goods trade increases demand.

Growth Drivers:

- Demand for fast fulfillment, last-mile delivery.

- Need for cold chain for agriculture, dairy, pharma.

- Government infra investments and IMCs / industrial corridors requiring good logistics backbone.

Recent Projects & Examples:

- IMCs (Industrial Manufacturing Clusters) being developed with infrastructure including connectivity. Hisar IMC near the airport is notable. Pi-India+2India Brand Equity Foundation+2

- Warehousing demand around NCR continues to rise.

Opportunities:

- Cold storage & temperature controlled warehouses.

- Integrated supply chain services (3PL, 4PL).

- Technology in warehousing: automation, inventory management, robotics.

- Last-mile delivery hubs.

Challenges:

- Land costs and utility infrastructure for large warehouses.

- Power reliability for cold storage.

- Regulatory issues for warehouse operations.

9. Healthcare & Medical Services

Why this sector is growing:

- Rising incomes, increased awareness, and demand for quality healthcare close to home.

- Medical tourism spillover (Delhi NCR), as many private hospitals in Haryana are already world-class.

Growth Drivers:

- Private hospital expansion, specialty care, diagnostic labs.

- Telemedicine / digital health.

- Government health spending and policy frameworks.

Recent Projects & Examples:

- Budget allocation increases in health expenditure. India Brand Equity Foundation+1

- Improvement in medical infrastructure (public-private collaborations) is noted in state industrial presentations.

Opportunities:

- Specialty clinics (cardiology, oncology), diagnostic chains.

- Telehealth & remote monitoring.

- Medical devices / pharma / biotech startups.

- Wellness / preventive health services.

Challenges:

- Regulatory complexity, licensing, compliance.

- Need for skilled medical personnel.

- Infrastructure costs.

10. Tourism, Hospitality & Eco / Adventure Tourism

Why this sector has potential:

- Haryana has cultural, heritage, ecological (hills, forests), and pilgrimage destinations. Also close proximity to Delhi NCR makes short-trip tourism viable.

- Growth in domestic travel, weekend getaways, and experiential/vacation tourism.

Growth Drivers:

- Rising disposable income and desire for leisure.

- Government initiatives to improve tourism infrastructure.

- Eco, adventure, wellness, rural tourism trends.

Recent Projects & Examples:

- Haryana investing in rural development, forest revival, environmental sustainability (e.g., Aravali revival plan) to improve environmental attractiveness. The Times of India

- Infrastructure investments and clean air/sustainability projects which support tourism.

Opportunities:

- Boutique resorts, homestays, adventure sports.

- Pilgrimage circuits, heritage tourism, cultural festivals.

- Wellness retreats, agro-tourism.

Challenges:

- Need for good connectivity and last-mile transport.

- Hospitality quality standards.

- Seasonality of tourism demand.

Cross-Sector Enablers & Government Policy Landscape

To understand why these sectors are rising, one must understand cross-cutting enablers and policies:

- Industrial Model Townships (IMTs) and Integrated Industrial Clusters: The government is developing multiple IMTs across Haryana (Ambala, Jind, Faridabad-Palwal etc.) with plug-and-play industrial infrastructure. The Week+1

- Regulation & Ease of Doing Business: Over 1,100 compliances reduced; many services moved online. Single-window clearances are functioning. The Week+1

- Textile Policy, Electronics Policy, Auto/EV incentives: Sector-specific policies with subsidies, tax benefits, capital investment subsidy etc. India Brand Equity Foundation+1

- Startup & Innovation Support: Incubators, grants, focus on GCCs, product development labs (like H-HUB). The Times of India

- Infrastructure & Connectivity: New industrial clusters, road, rail corridors (e.g., Hisar IMC near airport) providing better connectivity; emphasis on industrial corridors. Pi-India+1

Business Case Studies & Examples

To illustrate how these sectors are playing out in practice, here are a few case studies / real examples:

Case Study 1: Hisar Industrial Manufacturing Cluster

- A project near Hisar Airport (IMC Hisar) to develop about 3,000 acres at an investment of ~₹4,680 crore. It is intended to attract several manufacturing firms, provide modern infrastructure, create employment of over 10,000 people. Pi-India

- This cluster is strategically situated for both air connectivity and road transport, allowing sectors like heavy manufacturing, auto components, electronics etc. to set up without bottlenecks.

Case Study 2: Textile Policy & Atma Nirbhar Textile Policy

- The Atma Nirbhar Textile Policy 2022-25, extended to December 2026, offers capital investment subsidy, interest subsidies, SGST benefit. Removal of case caps under the capital investment subsidy scheme. This is aimed at boosting job creation (20,000 jobs as per policy documents) and attracting investments in textile units. projxnews.com+1

- Textile clusters like Panipat, Ambala have been able to leverage such policies to modernize facilities, invest in finishing/dyeing units, export products.

Case Study 3: Startup & Women Entrepreneur Growth

- Haryana has over 8,800 / ~9,100 startups recognized by DPIIT, with close to 50% being women-led in some reports. This indicates not only numerical growth but increasing inclusivity. The Week

- Incubator infrastructure being expanded: government and private incubators in universities, H-HUB launch in Gurugram. The Times of India

Case Study 4: Maruti Suzuki’s Investment at Kharkhoda

- In Haryana’s presentation, Maruti Suzuki India decided to invest ~₹7,410 crore to set up a third manufacturing plant in Kharkhoda. This is indicative of large players scaling capacity in the state. India Brand Equity Foundation

Opportunities & Where to Invest (2025-2030)

Here are the sectors / sub-areas that present high-conviction investment opportunities:

- EV infrastructure & component localisation: Battery packs, BMS, chargers.

- Electronics / Semiconductor fabs / module manufacturing: PCBs, sensors.

- Cold Chain & Food Processing: For agriculture-rich zones, investments in cold storage, clean packaging and exports.

- Textile modernisation & sustainable fashion: Eco-friendly textiles, at scale exports.

- Real estate & logistics hubs near transit corridors: Warehousing, mixed-use townships.

- Healthcare specialty & diagnostics: Secondary & tertiary hospitals in under-served districts. Telehealth.

- Tech startups in AI / drone tech / agritech: Drone manufacturing hub announced in Hisar; emerging product startups. The Times of India

- Renewable energy manufacturing & ESG linked businesses: Solar module plants, O&M services, energy efficiency services.

Challenges / Risks to Be Aware Of

While opportunities are strong, there are risk factors entrepreneurs and investors must keep in mind:

- Land acquisition & approvals: Delays, high costs, regulatory uncertainties.

- Power and utilities infrastructure: For manufacturing, consistent and affordable power & water supply is essential.

- Skill shortage: Particularly in high-skill areas (semiconductor, electronics, bio-manufacturing, EV tech). Need for training, skilling institutions.

- Environmental / compliance burdens: Pollution control, waste / wastewater management, especially in textiles, chemicals etc.

- Competition from other states: Many Indian states are offering competitive incentives for similar sectors. Haryana must keep improving its policies and ease of doing business.

- Global economic fluctuations: Foreign demand, supply chain disruptions, input cost inflation (raw materials, fuel, shipping).

Future Trends & What To Watch (2025-30)

To stay ahead, business players should anticipate and adapt to the following trends:

- Green / sustainable manufacturing: Emphasis on ESG, carbon footprints, energy efficiency. Clean tech demand from both domestic and international buyers.

- Automation, Industry 4.0: More robotics, IoT, smart factories to improve productivity, reduce labour costs.

- Digitalization in agriculture & supply chain: From farm to plate traceability, blockchain, precision farming, AI analytics.

- Localized production for global supply resilience: Many firms seeking to de-risk supply chains will look for multiple domestic sources; Haryana could become an important node.

- Health & wellness economy: Beyond hospitals, wellness, preventive health, fitness, diagnostics.

- Drone tech / aerospace / advanced materials: Given recent announcement of drone tech hub in Hisar, potential in these emerging industries. The Times of India

Sector Summary / Comparative Advantage

Here’s a sector-wise summary comparing key factors (capex intensity, regulatory complexity, labor skills needed, risk, time to yield return):

| Sector | CapEx Intensity | Regulatory / Compliance Load | Labor Skill Requirement | Time to ROI | Key Risks |

|---|---|---|---|---|---|

| Auto & Auto-Components / EVs | High | High (safety, emissions, certification) | High (engineers, automation) | Medium-Long (2-5 years) | Policy shifts, raw material costs |

| IT / Electronics / Hardware | Medium-High | Medium (electronics compliance, environmental) | High | Medium | Skilled workforce, global competition |

| Real Estate & Infrastructure | Very High | High (land, zoning, approvals) | Moderate | Long (5+ years) | Land acquisition, input cost inflation |

| Agriculture / Food Processing | Low-Medium | Medium (food safety, cold chain standards) | Moderate | Medium | Seasonality, logistics bottlenecks |

| Renewable Energy / Clean Tech | High | Medium-High (land, environmental, grid) | Moderate-High | Medium | Capital, grid / technical constraints |

| Textile & Garments | Medium | High (environmental, export standards) | Moderate | Medium | Competition, compliance |

| Startups / Innovation | Low-Medium | Medium (IP, tax, ease) | High | Variable | Access to funding, scaling challenges |

| Logistics / Warehousing / Cold Chain | Medium-High | Medium (environmental, land) | Moderate | Medium | Land, power cost, regulation |

| Healthcare & Medical Services | Very High | High (clinical, regulatory, accreditation) | High | Long | Skilled personnel, regulatory risks, infrastructure cost |

| Tourism & Hospitality | Medium | Medium (local regulations, land, environmental) | Moderate | Medium | Seasonality, infrastructure, competition |

This comparative view helps entrepreneurs choose sectors that align with their risk tolerance, available capital, and time horizon.

How to Enter / What Entrepreneurs Should Do (Actionable Steps)

If you’re considering starting or scaling a business in Haryana (in one of these sectors), here are practical steps and strategies:

- Select sector & location carefully: Use cluster mapping — e.g., auto near Manesar, textiles near Panipat, electronics near Sonipat or near IMCs like Hisar.

- Understand policy incentives: Check state’s Industrial & Investment Policy, textile policy, electronics policy, EV subsidies etc. Get clarity on eligibility.

- Land & infrastructure: Acquire land in notified industrial estates or IMTs; ensure connectivity (roads, power, water); check for SEZ or cluster status.

- Licensing, regulatory compliance: Environmental clearances, emissions, safety, certifications (quality / export), etc. Engage local consultants with prior experience.

- Build local supply chain & partnerships: For manufacturing, connecting with local component / parts suppliers; for agriculture, with farmers or cooperatives; for services, tie-ups with colleges / skill centers.

- Access finance & funding: Explore state government grants, bank/NBFC loans, venture capital (especially for tech). Consider also subsidies, tax breaks.

- Focus on quality & sustainability: Environmental compliance, product / service quality, export standards where applicable.

- Talent & skills: If sector needs high technical skills (electronics, EV, clean tech), invest in training, tie up with local educational institutions or skill development programs.

- Marketing & branding: Especially for consumer goods, textiles, food, tourism. For exports, you must meet global buyer expectations.

- Adopt technology early: Automation, digital tools, AI, supply chain tech, etc. can provide competitive advantage.

Conclusion

Haryana in 2025 is a state pregnant with opportunity across multiple sectors. From its strength in manufacturing, automobile, textile, agriculture, to rising domains like electronics, startups, logistics, and renewable energy, the state offers diverse paths for entrepreneurs and investors. Government policy and infrastructure are aligning with national goals (Make in India, EV push, green energy, digital India), providing tailwinds.

However, success will depend on execution: choosing the right sector, understanding regulatory and infrastructure challenges, investing in talent & quality, and being resilient to risks like input cost inflation and global demand swings.

If you are considering starting a business in Haryana, the time is ripe. Match your business idea with Haryana’s strengths — leverage its industrial clusters, proximity to NCR, policy support, and the moment’s global trends. With disciplined planning, the next few years could see high returns and impactful growth.

External Links

- IBEF — Haryana State Profile: Key sectors, GSDP, FDI & industrial policy. India Brand Equity Foundation

- India-Briefing — Haryana Investment Profile & Business Opportunities. India Briefing

- NPCsBlog / NPCS — Business ideas & MSME growth in Haryana. Niir Project Consultancy Services+1

- ProjxNews — Textile Policy extension and investment subsidy updates. projxnews.com

- Times of India / HT etc — Announcements about Hisar IMC, incubator, manufacturing hub vision. Nuclear Edge+3The Economic Times+3The Times of India+3

Image Prompts

For each major section / sector, here are image prompts to use with AI image generators:

- Haryana Economic Snapshot — “Infographic map of Haryana showing major industrial clusters (Gurugram, Manesar, Panipat, Sonipat, Hisar), with icons for auto, textiles, IT, agriculture, renewable energy.”

- Automobile & Auto Components / EVs — “Realistic image of an EV manufacturing plant in Haryana, workers around assembly lines, battery module being handled, robotics visible.”

- IT / Electronics — “Modern electronics manufacturing lab / clean room, employees in lab coats, PCB assembly, electronic devices being tested.”

- Real Estate & Infrastructure — “A sprawling industrial township (IMT) with model roads, factories, warehouses, modern housing, showing infrastructure.”

- Agriculture & Food Processing — “Farmers in green fields, packaged food processing plant in background, cold storage units, fresh fruits being packed.”

- Renewable Energy & Clean Tech — “Large solar park in Haryana’s rural landscape, photovoltaic panels, technicians inspecting, clear sky.”

- Textiles & Garments — “Interior of textile factory in Panipat: weaving looms, workers, finished carpets/rugs, dyes/labelling.”

- Startups & Innovation — “Co-working lab or incubator space, prototype models, entrepreneurs discussing, computers, 3D printers etc.”

- Logistics & Warehousing — “A logistics park along highway, large warehouse units, trucks loading/unloading containers.”

- Healthcare & Medical Services — “Modern hospital with medical professionals, diagnostic lab equipment, telemedicine consultation via laptop.”

- Tourism & Hospitality — “Boutique resort amidst hills or forest, tourists enjoying local food, wellness spa, cultural performances.”

SEO Metadata

Meta description (~155 characters):

Top 10 business sectors in Haryana for 2025: detailed guide on growth areas, investment tips, future trends in auto, tech, textiles, agriculture & more.

URL slug suggestion:

/top-10-businesses-haryana-2025

Meta tags:

<meta name="keywords" content="business in Haryana, top industries Haryana, investment Haryana 2025, auto manufacturing Haryana, startups Haryana"><meta name="description" content="Top 10 business sectors in Haryana for 2025: detailed guide on growth areas, investment tips, future trends in auto, tech, textiles, agriculture & more."><meta name="author" content="[Your Name / Brand]">

Internal linking suggestions (anchor text ideas):

- Haryana textile policy 2022-25 → link to a detailed article about state textile policy.

- Startups in Haryana ecosystem → link to article about startup numbers / incubators.

- Hisar Industrial Manufacturing Cluster → link to case-study or local news piece.

- Automobile & EV manufacturing in Haryana → link to auto components cluster profile.

- Renewable energy investment Haryana → link to solar / green energy policy summary.

If you like, I can convert this into a formatted HTML or Markdown blog post ready for publishing, or produce sector-specific data tables (growth rates, investment flows) to embed. Do you want those?