Introduction

The world is eating more protein than ever. Rising incomes, urbanization, and dietary shifts have increased global demand for high-quality protein — and by 2050, global protein needs are expected to be dramatically higher than today. Traditional animal agriculture has been the primary source for that protein, but it comes with clear environmental and resource costs: greenhouse gas emissions, heavy water use, deforestation and large land footprints. Meanwhile, technological advances and shifting consumer preferences are opening a second path: plant-based proteins.

Plant-based proteins — proteins derived from crops such as soy, peas, chickpeas, lentils, oats and others — are no longer niche. They underpin a fast-growing range of products from milk alternatives to meat analogs and have launched a vigorous market that combines food technology, crop science and new supply chains. For farmers, plant proteins are both a crop opportunity and a strategic pivot into higher-value agribusiness. For consumers and governments, plant proteins are a lever to improve public health and lower environmental footprints.

This guide explains the agronomy behind plant protein crops, how those crops are turned into foods, market dynamics and growth forecasts, environmental and nutrition impacts, economic opportunities for farmers, barriers to scale, and what the future might look like between 2025 and 2035.

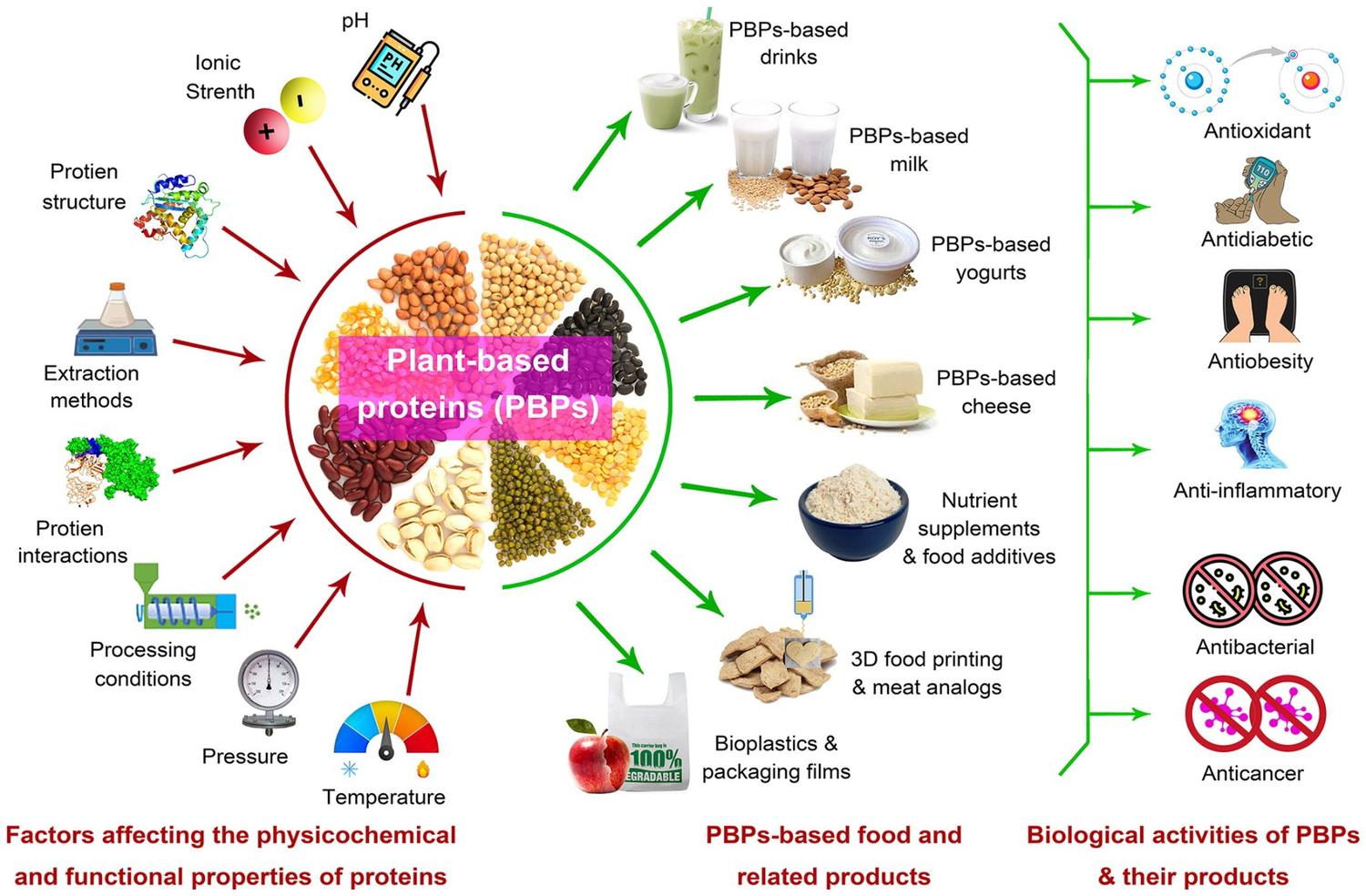

What Are Plant-Based Proteins?

Definition and scope

“Plant-based proteins” broadly refers to protein extracted or derived from plants for human food consumption. This includes whole-food uses (e.g., cooked beans or lentils), minimally processed formats (tofu, tempeh), and highly processed ingredient forms (protein isolates, concentrates, textured vegetable protein) used to make modern plant-based meats, dairy alternatives, protein powders, and protein-fortified foods.

Plant proteins differ from animal proteins in amino acid profiles and in their production footprints. Modern food science addresses nutritional gaps through blending crops and processing improvements, making many plant proteins functionally comparable to animal proteins in taste, texture and nutrition.

Common sources

Soy: Historically the dominant source for plant protein and the backbone of many meat and dairy analogs (tofu, tempeh, soy isolates). Soy offers a high protein yield per hectare and established processing infrastructure.

Pea: Rapidly popular due to allergen-friendly profile, neutral flavor, and good functional properties; pea protein isolates are widely used in meat analogs and protein beverages.

Chickpea & lentil: Important whole-food proteins and increasingly used in pastes, flours and extruded products.

Oats & barley: Used for dairy alternatives and as protein carriers.

Quinoa & amaranth: Niche but nutrient dense — often used in premium and gluten-free formulations.

Hemp & algae: Emerging alternative sources offering distinct nutritional profiles (omega-3s, unique protein blends).

How plant proteins are processed

At an ingredient level, plant protein processing typically yields:

- Flours (whole ground plant material) — used in bakery and whole-food applications.

- Concentrates (protein content ~50–70%) — obtained by removing some starch/fiber; used where moderate protein and functional properties are needed.

- Isolates (protein content >80–90%) — highly refined proteins that provide strong texturization and emulsification properties for meat analogs and beverages.

- Texturized vegetable protein (TVP) — produced using extrusion to create fibrous structures that mimic meat texture.

Advances in fermentation and precision processing (e.g., enzymatic fractionation) improve taste, remove off-notes, and enhance functional properties.

Farming for Plant-Based Proteins

Plant proteins are only as good as the crops behind them. The agricultural side — cultivar selection, soil management, pest control, harvesting and storage — determines crop yield, protein concentration, and ingredient quality.

Primary protein crops and agronomy

Soybean (Glycine max)

- Agronomy: Warm-season legume, often grown in large monocultures. Nitrogen-fixing, but modern management uses fertilizers and pesticides depending on region.

- Uses: Oil and meal; meal provides the primary animal feed protein globally and the backbone of many plant-based industries.

- Considerations: Soy expansion links to deforestation in some regions; responsible sourcing and yield intensification are priorities.

Pea (Pisum sativum)

- Agronomy: Cool-season legume; adaptable to temperate zones (Canada, Europe, parts of Asia). Pea tolerates less fertilizer input due to nitrogen fixation and is often integrated in rotations.

- Uses: Pea protein isolates for meat alternatives and dairy analogs.

- Considerations: Global demand for pea protein has risen sharply, altering export patterns and crop economics.

Chickpea & Lentils (Cicer arietinum; Lens culinaris)

- Agronomy: Suited to semi-arid regions; important in rotation for soil health.

- Uses: Whole food, flour, and protein concentrates; culturally preferred in many regions (India, Middle East).

Oats & Barley

- Agronomy: Cool climates, good for soil structure. Oats are favored for dairy alternatives (oat milk).

- Uses: Oat milk, oat protein concentrate, functional blends.

Quinoa, Hemp, Algae

- Agronomy: Niche crops with specific climates and production systems; quinoa often grown in Andean regions; hemp and algae require specialized cultivation/processing.

Crop rotations, soil health, and nitrogen management

Legumes (soy, peas, chickpeas, lentils) are powerful rotation partners because they fix atmospheric nitrogen via symbiotic bacteria, lowering synthetic fertilizer needs for subsequent cereals. Smart rotations with cereals (wheat, barley, maize) reduce disease cycles and improve overall system resilience.

Key agronomic practices for protein crops:

- Rotational diversification to suppress pests/diseases and improve soil organic matter.

- Cover cropping to reduce erosion and add organic inputs.

- Integrated pest management (IPM) to minimize pesticide reliance.

- Balanced nutrient management — especially phosphorus and potassium — to maximize protein content and seed quality.

Sustainable / regenerative practices

Many growers supplying plant-based ingredients adopt regenerative practices that deliver yield plus ecosystem benefits:

- Reduced tillage or no-till to preserve soil carbon.

- Legume-led rotations to cut fertilizer inputs.

- Agroforestry (where suitable) to diversify income and sequester carbon.

- Precision fertilization (variable rate) to optimize inputs.

These practices not only reduce environmental footprint but can also improve seed protein content and market premiums for sustainable sourcing.

Technology & supply chain: breeding, precision ag, post-harvest

Plant breeding: New varieties optimized for protein content, processing qualities (e.g., low off-flavor), and climate resilience are central. Breeding programs target higher protein concentration, disease resistance, and consistent functional properties.

Precision agriculture: Sensors, drones, and satellite imagery help optimize water and input use, increasing resource efficiency and consistent crop quality for processors.

Post-harvest handling: Clean, low-moisture storage and standardized drying maintain seed quality. Processing capacity (e.g., wet fractionation plants for isolates) is a crucial bottleneck: countries with processing hubs (Canada for pea protein; US/China for soy processing) hold a strategic advantage.

How Plant-Based Proteins are Turned into Foods

Transforming farmed crops into delicious products requires food science and industrial processes.

Common processing pathways

Mechanical milling & fractionation

- Dry milling separates protein-rich fractions from starch/fiber; wet fractionation uses aqueous processes to extract proteins with different functional traits.

Texturization (extrusion)

- Using high-temperature, high-shear extrusion, protein concentrates are converted into fibrous, meat-like textures (used in burgers, nuggets, strips).

Isolation & purification

- Protein isolates created via centrifugation, filtration and drying yield high-protein powders for beverages and formulations.

Fermentation

- Microbial fermentation (traditional and precision fermentation) can produce flavor compounds, improve functionality, or create proteins not available from plants (e.g., animal-identical dairy proteins produced by microbes).

Fermentation and hybrid approaches

Hybrid products blend plant proteins with fermentation-derived ingredients (e.g., heme produced via fermentation blended into plant matrices to mimic meat flavor). Precision fermentation enables low-resource production of complex proteins (casein, whey analogs, hemoproteins) that dramatically elevate sensory quality.

Product formats

- Dairy alternatives: Oat, soy, almond milks; fermented plant yogurts; ice creams.

- Meat analogs: Burgers, sausages, mince, chicken alternatives using extruded or binded plant matrices.

- Protein snacks & bars: Using isolates and concentrates for high protein content.

- Protein powders & supplements: For sports nutrition and meal replacement.

Market Size, Trends & Growth Projections

Plant-based proteins are an expanding market with strong investor interest, rapidly changing demand patterns, and evolving regional dynamics.

Global market size & growth: Estimates vary by methodology, but many market reports converge on strong growth. For example, several reputable industry analyses put the global plant-based protein market in the low-to-mid tens of billions of USD range in the mid-2020s, with compound annual growth rates (CAGR) generally in the high single digits to low double digits through the 2020s. One analysis estimated the plant-based protein market at approximately USD 22.3 billion in 2024, with projections to grow toward the mid-30s by 2030. MarketsandMarkets

Retail-level context: In the U.S., plant-based foods (a broader category than only proteins) were reported as an $8.1 billion retail market in 2024, showing high household penetration even while some categories faced short-term softening. The Good Food Institute

Regional dynamics

- North America: Early leader in innovation and consumer adoption (Beyond Meat, Impossible, Oatly). Investment into plant proteins is high but incumbents face margin and demand cycles.

- Europe: Strong policy and consumer interest in sustainability; robust dairy and meat alternative growth.

- Asia-Pacific: Fastest growing by volume in many forecasts — China, Singapore and Southeast Asia show rapid product adoption and local supply chain development. China’s demand for pea protein and other isolates shapes global trade flows. Reuters

- India: A growing market leveraging a large vegetarian population and expanding startup ecosystem. Market reports highlight significant projected CAGR for plant protein markets in India, with the sector expected to expand multiple-fold through the 2030s. IMARC Group

Demand drivers

- Flexitarian consumers: People reducing meat consumption but not eliminating it are a major growth cohort.

- Health & wellness trends: Interest in lower saturated fat, higher fiber diets.

- Sustainability awareness: Brands claiming lower footprints attract conscious buyers.

- Convenience & innovation: Ready-to-cook and ready-to-eat formats expand usage occasions.

Key players & supply dynamics

- Large consumer brands: Beyond Meat, Impossible Foods, Oatly, Kellogg (plant brands), Danone (Alpro), and others.

- Ingredient suppliers & processors: Companies in Canada, Europe, and China processing peas, soy and other proteins into isolates and concentrates.

- Startups & scale-ups: Hundreds of smaller firms innovating on ingredients (e.g., novel proteins, fermentation platforms) and product formats.

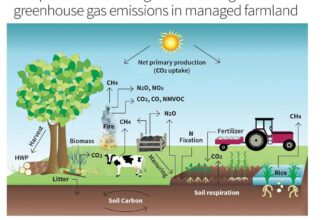

Environmental Benefits & Comparative Footprint

Plant-based proteins generally offer large per-unit advantages over conventional beef and, to a lesser extent, poultry and pork — though impacts vary by crop, region and farming methods.

Greenhouse gas emissions and water/land use: Plant proteins typically emit far less GHGs and use less water and land. Comprehensive assessments (including life cycle analyses) report that, compared to beef, many plant-based meat analogs and their ingredient crops can reduce greenhouse gas emissions dramatically and use significantly less water. The Good Food Institute reports that plant-based meat can reduce water use by up to 99% and cultivated meat by 66% compared to conventional beef in certain metrics; percentages depend on system boundaries and substitution assumptions. The Good Food Institute

Land footprint & biodiversity: Animal production — particularly beef — is a major driver of land use and deforestation. Shifting calories and protein production to crops with higher protein yields per hectare (or to lower-land pathways like fermentation) can spare land and deliver biodiversity co-benefits.

Pollution & nutrient runoff: Plant systems, especially when using regenerative practices, can reduce nutrient runoff and local water pollution compared with intensive livestock systems where manure management is poor.

Co-benefits: Many plant protein crops improve soil health (legumes add nitrogen), fit into climate-smart rotations, and can be produced closer to consumers, reducing transport emissions.

Health, Nutrition & Food Security

Nutritional quality

Plant proteins have historically been criticized for incomplete amino acid profiles. However, blending crops (e.g., legumes + cereals) and using modern processing can create complete protein profiles. Many plant proteins are high in fiber, low in cholesterol, and contain bioactive compounds and micronutrients.

Fortification & blending: A typical commercial strategy is combining pea + rice proteins or pea + oat to fill amino acid gaps, or fortifying with vitamins/minerals (B12, iron) where necessary.

Health outcomes

Population studies link higher plant intake with lower risks of cardiovascular diseases, some cancers, and metabolic conditions. While ultra-processed versions of plant products require careful evaluation, whole-food plant proteins (beans, lentils, soy) are consistently associated with health benefits.

Food security & resilience

Plant protein crops — because of shorter production cycles and lower resource intensity — can be part of strategies to increase resilience to climate shocks and food price volatility. Diversifying protein supply chains (local pea processing, decentralized dairy alternatives) helps reduce dependence on long global feed chains.

Economic Opportunities & Farmer Impacts

Plant proteins create new commercial avenues across the value chain.

For farmers

Crop premiums and diversification: Growing high-demand protein crops (pea, chickpea, specialty soy) can bring better margins than commodity cereals in many regions when markets and processing infrastructure exist.

Value addition: Farmers or cooperatives that invest in local processing (dry fractionation, oilseed crushing, storage & cleaning) capture more value than selling raw grain.

Contract farming & offtake agreements: Food companies often sign supply agreements with farmers to secure high-quality protein feedstock — offering price stability and access to technical support.

For rural economies

Processing plants (isolation, extrusion) create new industrial jobs near growing regions. The expansion of plant protein demand can drive investments in logistics, cold chain (for some ingredients), and packaging sectors.

Export potential

Countries that build processing capacity for proteins (e.g., pea protein isolation in Canada and China’s growing import demand for peas and pea protein) position themselves for export revenue. Shifts in trade patterns (e.g., Russia’s changing pea export role to China) demonstrate how geopolitics and agricultural supply can rapidly evolve in this space. Reuters

Challenges & Barriers to Scale

Despite the promise, several barriers must be addressed.

Taste, texture and consumer acceptance

Sensory quality remains critical. Highly processed products can be high in sodium and additives; some consumers are moving toward minimally processed whole-food proteins (tempeh, beans) rather than highly processed meat analogs. The surge in demand for less-processed fermented products (e.g., tempeh) reflects this shift. The Guardian

Cost & price parity

Many plant-based products still carry price premiums, especially where processing and ingredient supply chains are not yet optimized. Scaling processing capacity and improving yields through breeding and agronomy are key to price parity.

Supply chain & raw material consistency

Ingredient quality must be consistent for large processors. Variability in protein content, flavor compounds, or anti-nutritional factors requires supply chain coordination and sometimes investment in seed and agronomic programs.

Regulatory environment & labeling

Regulations over labeling (“meat”, “milk”, “cheese” naming) differ across jurisdictions and can influence consumer perception and market access. Approval pathways for novel ingredients (e.g., novel proteins from algae or fermentation) can be slow and expensive.

Competition & agricultural transition

Shifting diets affects livestock sectors and feed markets, which has complex social and economic implications; policies are needed to manage transitions for communities reliant on animal agriculture.

Case Studies & Success Stories

Pea protein scaling & trade flows

Pea protein has emerged as a star ingredient because of its neutral taste and functional properties. Canada historically dominated pea exports, but shifting trade patterns (e.g., Russia expanding pea exports to China) illustrate how supply chains and geopolitics influence the ingredient market. These trade shifts have implications for global pea protein availability and price. Reuters

Fermentation + plant hybrids

Companies combining plant bases with fermentation-produced flavor or functional molecules are achieving rapid improvements in taste and mouthfeel. This hybrid approach is a short-to-medium term route to mass market acceptance.

India: pulses, tradition & startups

India has a deep cultural tradition of pulse consumption (chickpea, lentils). Modern startups in India blend this heritage with product innovation — producing ready-to-cook plant protein foods and ingredient processing for local and export markets. Market analyses project strong CAGR for India’s plant protein sector driven by health, affordability and vegetarian culture. IMARC Group

The Future (2025 → 2035)

What comes next? Multiple converging technologies and market forces point to three plausible scenarios.

Technology roadmaps

Breeding & seed: Faster breeding for high protein content, low off-notes, and climate resilience.

Precision ag: Lower input use, better consistency in ingredient quality.

Fermentation & cell tech: Precision fermentation will produce animal-identical proteins (dairy, egg proteins) more cheaply over time, while cultivated meat may penetrate higher margin product lines.

Processing decentralization: Smaller, regional fractionation plants reduce transport costs and support farmer margins.

Market scenarios

- Conservative: Plant proteins remain a growing niche (low double-digit market share in proteins).

- Mainstream: Major operators achieve price parity; flexitarian diets become default for many consumers (double-digit market share).

- Transformative: Widespread substitution and technology breakthroughs (precision fermentation, powerful economies of scale) lead to plant & microbe proteins capturing a significant global share of protein calories.

Recommendations for stakeholders

Farmers: Invest in crop rotations, adopt improved varieties, engage in contract farming and cooperative processing to capture value.

Policymakers: Support processing infrastructure grants, R&D in breeding, and clear regulatory pathways for novel foods.

Brands & startups: Focus on taste, affordability, and transparent sustainability claims.

Investors: Back processing capacity and supply chain coordination — these often determine long-term profitability.

Conclusion

Plant-based proteins are reshaping the future of food. They present an enormous opportunity to produce nutritious protein with a much lower environmental cost than many animal systems — while also creating new economic value for farmers, processors and food companies. The path from field to fork involves agronomy, processing, technology and policy, and progress in all those domains will determine how fast plant proteins scale.

To fully realize the promise, stakeholders must work together: farmers and agronomists must deliver consistent, quality feedstocks; processors and food scientists must perfect taste and texture at scale; brands must build consumer trust; and policymakers must create enabling environments for investment and trade. With the right alignment, plant-based proteins can be a pillar of healthier diets, more resilient food systems, and lower planetary impact in the coming decade.

External Links (high-authority sources)

- Good Food Institute — Environmental impacts and market research: “Environmental impacts of alternative proteins.” The Good Food Institute

- MarketsandMarkets — Plant-based protein market analysis and projections. MarketsandMarkets

- Grand View Research — Plant-based meat market and growth trends. Grand View Research

- IMARC Group — India plant-based protein market report (India specifics and forecasts). IMARC Group

- Good Food Institute / PBFA — U.S. retail plant-based food market overview (retail sales snapshot). The Good Food Institute

- Reuters — Agricultural trade shifts impacting pea exports & global supply. Reuters

- The Guardian — Consumer trend example: tempeh growing popularity (illustrates shift to less-processed meat alternatives). The Guardian

Image Prompts (for AI image generation)

Introduction

- “Infographic style image: world map with rising protein demand arrows, icons for plant proteins (peas, soy, chickpeas), and environmental impact bar charts.”

What Are Plant-Based Proteins?

- “High-resolution photo-realistic collage: soybeans, yellow peas, chickpeas, oats and hemp seeds in bowls, labeled with protein percentages.”

Farming for Plant Proteins

- “Panoramic farm scene showing pea and soybean fields, a farmer inspecting seed pods, and a drone mapping the fields (precision ag).”

Processing & Product Formation

- “Industrial scene: wet fractionation / protein isolation facility interior with stainless steel tanks and technicians; inset close-up of extruded plant-based burger patty.”

Market Growth & Trends

- “Infographic: stacked area chart showing market growth from 2020 to 2035 with regional breakdown (North America, Europe, Asia-Pacific, India).”

Environmental Benefits

- “Comparison infographic: side-by-side visuals of a cow pasture vs. plant protein field with icons showing CO₂, water, and land footprints.”

Health & Nutrition

- “Split image: athlete pouring plant protein shake vs. family cooking lentil stew; overlay icons for amino acids, fiber, vitamins.”

Economic Opportunities

- “Marketplace scene: small processing plant next to farmland, trucks loading pea protein bags, and a sign reading ‘Local Processing = Higher Farmer Income’.”

Challenges

- “Conceptual art: balancing scale with ‘taste & texture’ on one side and ‘affordability & supply chain’ on the other.”

Future

- “Futuristic lab & farm hybrid: vertical indoor farming racks of protein crops, bioreactors for fermentation products, and autonomous harvesters.”

SEO Meta Data

Meta description (≤155 characters):

Explore plant-based proteins: how they’re farmed, processed, their environmental & health benefits, and market growth forecasts through 2030.

Suggested URL slug:

plant-based-proteins-farming-benefits-market-growth

Suggested meta tags:

- plant-based proteins

- plant protein farming

- plant-based meat market

Internal linking strategy (anchor text ideas):

- Link to a post on “regenerative farming techniques” when discussing soil health and rotations.

- Link to “precision agriculture tools” for the technology section (seed breeding, drones).

- Link to “carbon farming & sustainability” when covering environmental benefits and co-benefits.

- Link to “plant protein processing explained” for readers who want a detailed technical deep dive on isolation and extrusion.